There are many companies you can consider when searching for a San Antonio-based financial advisor. You can find a list of these companies on Barron's, which ranks financial advisors based on the assets under management, revenue produced for the firm, and client service.

Arrow Wealth Advisors

Arrow Wealth Advisors is an advisory team that serves San Antonio. They focus on financial planning, investment management, and insurance plans. They also offer education about retirement and college readiness. These professionals also offer advice on estate planning, tax planning, fraud prevention, and more.

The firm offers financial planning services in San Antonio to individuals, families, as well as businesses. They collaborate with clients from all walks of life to develop a unique financial plan that suits their particular circumstances. They are certified financial planners and adhere to fiduciary standards. In addition, they help clients plan for their retirement and assist with charitable giving strategies.

In addition, Arrow Wealth Advisors offer products with performance-based fees. These fees are paid to advisors if the client's portfolio is higher than the benchmark (usually an index). This can be problematic because incentive-based fees can cause financial advisors to take inappropriate risks. For example, a fee-based financial advisor may be more inclined to invest in mutual money with higher risks than funds that do not have incentive fees. This can be detrimental to client portfolios, particularly during a down market.

Intercontinental Financial Advisors

Intercontinental Financial Advisors is the best financial advisor in San Antonio. Founded in 1981, this private investment firm has been serving high-net-worth clients for over four decades. The firm's independence and expertise are well-known. Every client is treated individually and the firm takes a personal approach. The firm's investment professionals provide comprehensive financial planning services to individuals and families.

RBC Wealth Management San Antonio, Texas caters to many clients. The firm offers a complete range of financial services that include investment management and retirement needs analysis, insurance, tax planning, as well as college education. The company has been featured in the San Antonio Business Journal and is backed by a team of securities industry professionals who have earned multiple designations.

Howard Dawson, Intercontinental's financial advisor, helps clients to reach their financial goals by managing many client relationships. He holds an MBA in International Business at the University of the Incarnate Word as well as a Bachelor's degree in Spanish at the University of Texas at Austin. He has also been recognized as a San Antonio Business Journal "40 under 40" award winner and a member of Leadership San Antonio Class 35. His financial planning and investment management expertise has been featured by several publications, including Financial Advisor Magazine. Barron's and the Associated Press.

Texas Financial Advisory

Texas Financial Advisory could be able to assist you if your interest in investing is genuine. The firm offers services in investment advisory and products in insurance. Texas Financial Advisory is a financial advisory firm that works with investors to devise strategies that will help them meet their financial goals. These professionals can help you make educated decisions about your finances, whether you are new to investing or have an old perspective.

Texas Financial Advisory has an office in San Antonio, Texas. The firm currently has 394 client accounts and oversees $83,836,899 worth of assets. Fees depend on the type and number of assets being managed. The firm also offers financial planning seminars and portfolio administration for individuals as well small businesses.

The firm's top Texas-based financial advisors work exclusively for clients. This pricing structure ensures that clients' interests are met and the advice they give is objective and objective. Clients benefit from the fee-only pricing structure, which helps to develop long-lasting relationships and prevents them feeling pressured by their suppliers.

FAQ

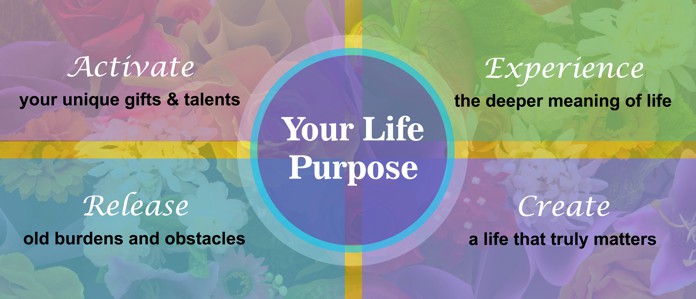

What are you focusing on when coaching life?

The ability to help people develop their skills and strengths to achieve goals.

It is important to learn about their thoughts, how they think, and what motivates. To help them find solutions to problems they have.

To give them self-belief and confidence so they can take control of their lives.

To help them make better decisions and move forward.

Teach them how you can make them happier, healthier, more fulfilled, as well as more successful.

To help them develop practical communication skills.

To encourage them to build strong relationships.

To show them how to manage their time effectively.

To assist them in understanding how to motivate others and themselves.

To teach them to lead by example.

What will I get from my life coaching session?

During the first session of your life coaching session, you will share your goals and your needs. We will then discuss your goals and help you identify obstacles that may be preventing you reaching those goals. Once we've identified the problem areas, we'll design a plan of action to help you reach your goals.

We will keep you informed every month, to ensure that everything is going according to plan. Please let us know if there are any issues.

We are here for you every step of the way. You will always feel supported.

Can a life coach help with anxiousness?

There are many anxiety disorders. Different people respond differently to the same stimulus. It is important to identify the type of anxiety that you are trying to help.

This will allow you to develop a plan for treatment that addresses their specific issue.

In general, life coaching helps people gain control over their lives, so it is often helpful for those struggling with depression, anxiety, stress, and relationship issues.

Look into whether the coach is trained to help clients deal with these issues.

Check to see if the coach offers group counseling or workshop services.

This will allow for you to meet up regularly with him/her and discuss progress.

Also, inquire about the coaching experience and credentials.

Statistics

- According to ICF, the average session cost is $244, but costs can rise as high as $1,000. (cnbc.com)

- 80 percent of respondents said self-confidence improved, 73 percent said relationships improved, 72 percent had better communication skills, and 67 percent said they balanced work and life better. (leaders.com)

- If you expect to get what you want 100% of the time in a relationship, you set yourself up for disappointment. (helpguide.org)

- People with healthy relationships have better health outcomes, are more likely to engage in healthy behaviors, and have a decreased mortality risk.1 (verywellmind.com)

- These enhanced coping skills, in turn, predicted increased positive emotions over time (Fredrickson & Joiner 2002). (leaders.com)

External Links

How To

How to become a Life Coach

The most asked question online is "How do I become a coach?" There are many routes to becoming a Life Coach, but these steps will help you get started as a professional.

-

Find out what you want to do. Before you can pursue any career, your passions and interests must be known. If you don’t know what you are interested in, coaching can be very simple. Think about why you are interested in this profession before looking at other options. If you are thinking "I would like help people", then it is time to look into how to be a life coach.

-

You should create a plan. Make a plan once you have decided what you want. Read books and learn about the profession. Note down all you have learned and keep them in your notebook so you can easily refer to them. Do not rush into things without a clear vision and goal. You should set realistic goals for the next few years.

-

Be patient. Being a life coach requires patience and dedication. The hardest part of any training program is the first one. After your initial training, you may spend as much as 2-4 hours per day working with clients. You will be required to work weekends and long hours. If you are passionate about what you do, you won’t feel tired even if it takes you 14 hours per week.

-

Get certified. To become a licensed personal coach, you will need certification through a recognized organization like NLP Certification Institute (NLCI). This certification will make you more credible to potential employers and help open doors for new opportunities.

-

Network. Do not forget to build relationships with experts and coaches in your field. Learn from other coaches and seek their advice. Once you have enough experience you can offer assistance to others who are just starting out in coaching.

-

Keep learning. Never stop learning. Keep reading blogs, articles, books and books about this field. Learn more about human behavior, psychology, communication skills, etc.

-

Keep positive. Negative attitude is the number one mistake made by new coaches. A positive outlook is key to success as a life coach. Your words, actions, and attitude will reflect on clients. Keep an optimistic attitude and smile!

-

Practice patience. As mentioned earlier, the first year of practicing as a life coach is usually the hardest. Take breaks now and then and remind yourself why you decided to become a life coach in the first place.

-

Enjoy the process. It may seem like an endless road ahead, but the rewards are far greater than the obstacles. Along the way, you will meet incredible people and grow personally.

-

Have fun. Enjoy the ride. Have fun.